Primer: Section 45Q Tax Credit for Carbon Capture Projects

June 15, 2019 | Blog

The Great Plains Institute has published the following primer on the 45Q tax credit. The original blog post is reprinted below and can also be viewed on the Great Plains Institute website.

The Section 45Q tax credit for carbon capture projects provides a foundational policy for increasing deployment of carbon capture projects in the US. This primer was prepared to provide a succinct overview of this important tax credit, which the IRS currently seeks comment on as they prepare to develop implementation guidance.

What is the Section 45Q Carbon Capture Tax Credit?

Section 45Q of the US tax code provides a performance-based tax credit for carbon capture projects that can be claimed when an eligible project has:

- securely stored the captured carbon dioxide (CO2) in geologic formations, such as oil fields and saline formations; or

- beneficially used captured CO2 or its precursor carbon monoxide (CO) as a feedstock to produce fuels, chemicals, and products such as concrete in a way that results in emissions reductions as defined by federal requirements.

Background: Bipartisan FUTURE Act Reforms 45Q

As part of the Bipartisan Budget Act of 2018, Congress passed legislation originally introduced as the FUTURE Act (Furthering carbon capture, Utilization, Technology, Under-ground storage, and Reduced Emissions) with broad bipartisan support to expand and reform 45Q. To implement the reformed 45Q, the US Treasury requested public comments in IRS Notice 2019-32 on several key issues. Comments will be due 45 days after the notice is published in the Federal Register.

Eligibility to Claim the 45Q Tax Credit

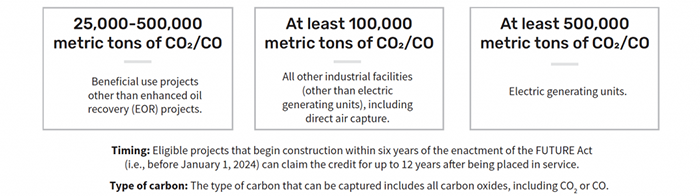

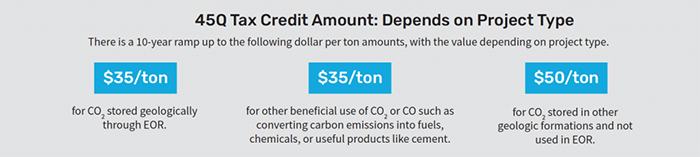

The party eligible to claim the tax credit is the owner of the capture equipment. That party must physically

or contractually ensure the storage or utilization of the CO2 or CO and may elect to transfer the credit to another party that stores or puts the CO2 or CO to beneficial use. Annual carbon capture thresholds, as shown below, determine the eligibility of different types of facilities for the credit.

Why is the 45Q tax credit important?

The revamped federal 45Q tax credit provides a foundational policy for incentivizing carbon capture deployment in multiple industries, much like the role the federal production tax credit and investment tax credit has played in wind and solar development, respectively. To fulfill carbon capture’s full potential for reducing emissions, enhancing domestic energy and industrial production, and protect-ing and creating high-wage jobs, a suite of federal and state policies is ultimately required to comple-ment 45Q and drive investment, innovation, and cost reductions sufficient to achieve economywide deployment (just as a full portfolio of federal and state policies has accomplished for wind and solar).

How does 45Q support carbon capture projects?

The expansion and reform of 45Q reduces the cost and risk to private capital of investing in the deployment of carbon capture technology across a range of industries, including electric power generation, ethanol and fertilizer production, natural gas processing, refining, chemicals production, and the manufacture of steel and cement.

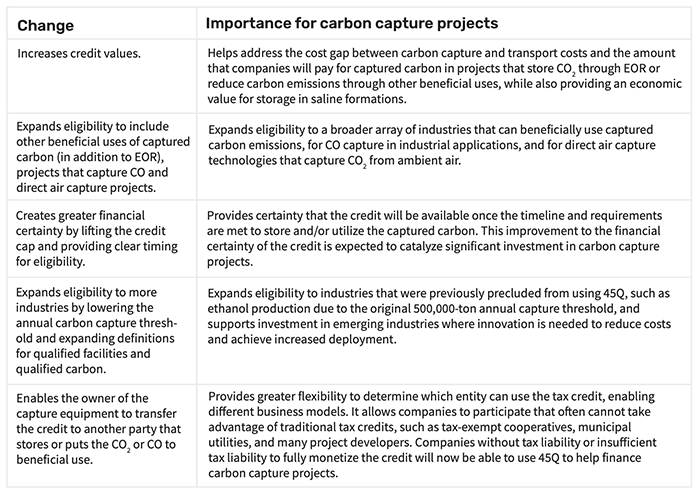

Key Elements of the Reformed 45Q

The expansion and reform of 45Q provided important changes that will attract investment in projects.

Learn about key changes that were made to 45Q with the passage of the FUTURE Act.